In August, the market gradually entered the peak of the second half of the year. Upstream packaging paper mills rose in the early part of the month, but prices of finished paper fell steadily due to waste paper prices; downstream demand for packaging paper improved slightly in mid-August, with a slight rise, but still not a climate. According to past practice, paper mills will rally in late August and early September. But this year is different from previous years, even in early September, the demand for corrugated boards and paperboards has not improved significantly, paper mills inventory pressure on the high side, but the demand is weak prices can not see a pick-up.

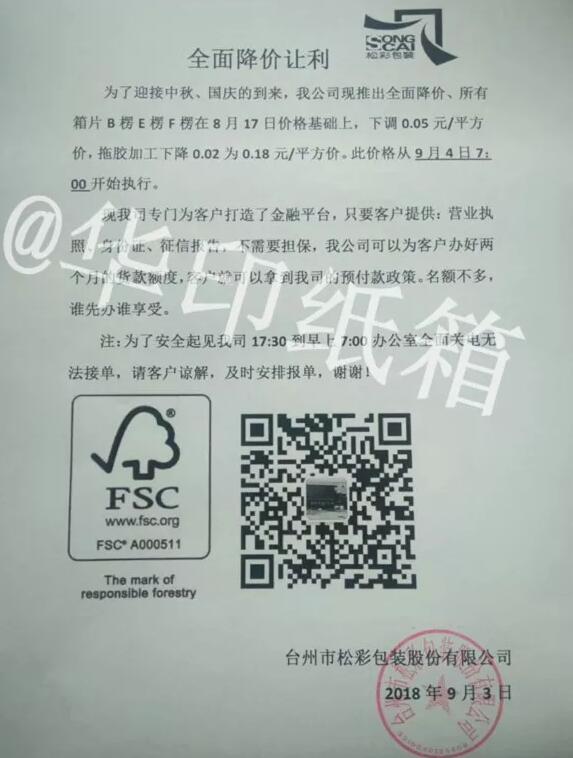

On August 24, Zhejiang Wenzhou Dongmu Paper Co., Ltd. also announced price cuts: due to a drop in the price of base paper, the price of medium tiles per square was reduced by 0.10 yuan, thin tiles per square by 0.13 yuan, micro tiles per square by 0.13 yuan, and open paper per square by 0.06 yuan.

Why does not the cardboard rise or fall in the peak season?

1, the policy of external elimination is stricter.

On May 2, the General Administration of Customs issued a special document "Notice of Customs Administration on Risk Early Warning and Supervision Measures for Importing American Waste Raw Materials", which caused a huge wave in the corrugated paper market. The price of corrugated paper rose by more than 1000 yuan/ton in the first ten days only. Far higher than expected, but also ahead of schedule overdraft of some of the later orders, resulting in a weak market.

Up to now, the total nuclear quantity of imported waste paper in 2018 is 14.328 million tons, down 49% from the previous year. Most of the nuclear quantities are in the hands of large-scale paper enterprises, with the advantage of raw material cost, the paper prices of individual bases of paper enterprises in large-scale are adjusted to lower than those of the surrounding small and medium-sized paper enterprises. From 12:01 noon on August 23, China imposed an additional 25.5% levy on US waste. The tariff of 50% is beneficial to the rise of the national waste price, which forms a favorable cost support to the price of corrugated paper. However, the high cost can not be smoothly transmitted to the downstream due to the weak demand, and the cost support evolves into the cost pressure of paper enterprises.

2, the reduction of domestic exports will indirectly affect the demand for corrugated paper.

3, the number of imported base paper increased significantly.

According to customs data, the import volume of corrugated paper in January-July 2018 reached 603,500 tons, up 122.9% from the same period last year. Imported corrugated paper with the advantage of good quality and low price flooded into China, which has a great impact on the domestic supply of goods, making the original. Over-high inventory pressure on paper enterprises worsened the situation, but also made many paper enterprises to strive for customer resources to fight a price war.

4, the downstream purchasing mentality tends to be rational.

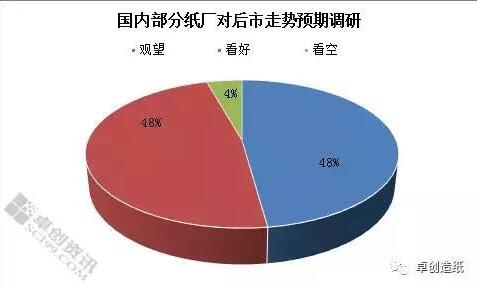

Due to the sharp rise and fall of paper prices in the past two years, the downstream will make corresponding analysis and judgment on the future market when facing the above situation, purchasing will be appropriate according to their own situation, no longer blindly reserve a large number of raw paper inventory. This leads to the paper enterprises inventory pressure is difficult to shift downward, supply pressure is high. Under the circumstances, the rise in paper prices is insufficient.

Some small and medium-sized paper mills are facing elimination, and the two stage factories are entering the integration period.

1. Industry concentration: the overall supply of raw materials and waste paper is expected to tighten, the possibility of a sharp decline in prices is small. However, there is no sign of improvement in downstream demand, the pressure of paper enterprises shutdown will increase, coupled with the dual impact of cost-side pressure, some small and medium-sized enterprises will be eliminated, the cost advantage of large-scale enterprises highlights, industry concentration. The degree will continue to improve.

2. Second-class factory enters the period of industry integration: due to the boom of packaging paper industry in the past two years, the rapid expansion of the downstream second-class factory and the continuous release of new production capacity, but after entering 2018, the market demand has shrunk, and the contradiction between supply and demand has led to the second-class factory enters the period of industry integration again.

3. Finding low-cost substitutes: Although the corrugated paper market is in a weak state of operation, due to the high cost of raw materials, paper prices are less likely to fall sharply in the short term.

In the four quarter, the market is hard to say, and it is expected that tile paper will be in the range of 4000-4500 yuan / ton.

In addition, some paper companies still have new capacity plans, so although the fourth quarter is the traditional market demand season, but affected by the accumulation of supply and demand contradictions, Zhuochang anticipates that the corrugated paper market in the fourth quarter is unspeakably optimistic, paper prices or to maintain range shocks mainly, of which November-December does not rule out the possibility of a decline, but because of raw materials used yellow paper prices will remain. At a high level, paper prices are expected to fluctuate between 4,000 and 4,500 yuan per ton, with a limited decline in paper prices supported by cost pressures from paper companies.